can you pay california state taxes in installments

If you use the California Franchise Tax Boards FTB website you will enter your personal and payment information as requested no information will be pulled from any other location. Per Revenue and Taxation Code State of California Section 2703 the second installment of taxes may be paid separately only.

Understanding California S Sales Tax

The state of California To pay your.

. An Installment Agreement allows you to pay your taxes over an extended period of time while avoiding collection actions from the IRS such as garnishments and levies. A local county taxpayer can use Easy Smart Pay to make his or her yearly property tax payments. Payment plans may not be for longer than 60 months.

If you cant pay your tax bill in 90 days and want to get on a payment plan you can apply for an installment agreement. You can pay the amount in 60 months or less. If you owe a tax debt to the Georgia Department of Revenue and cannot afford to pay it all at once you can request a payment plan to settle your debt over time.

Visit IRSgovpaywithcash for instructions. Instalments are due and payable until the 15th day of the 4th 6th 9th and 12th month of the taxation year. You may be able to make monthly payments but you must file all required tax returns first.

Usually you can have from three to five years to pay off your taxes with a state installment agreement. Do You Pay Property Taxes Monthly Or Yearly In California. Solvent can also help.

If approved it costs you 50 to set-up an installment agreement added to your balance. We can set up payment plans for both individuals and businesses. Taxes will be mailed on October 1st.

Pay through Direct Debit automatic monthly payments from your checking account also known as a Direct Debit Installment Agreement DDIA. S companies must make estimated tax payments for certain taxes. The highest rate is levied at income levels of at least 526444.

Pay your taxes by debit or credit card online by phone or with a mobile device. You can request a payment agreement in instalments. It may take up to 60 days to process your request.

Typically you will have up to 12 months to pay off your balance. If you are unable to pay your state taxes you can apply for an installment agreement. Affordable Reliable Services.

By November 1st the first installment must be paid and by December 10th the final installment must be payable. Find Out Now For Free. You can make a cash payment at a participating retail partner.

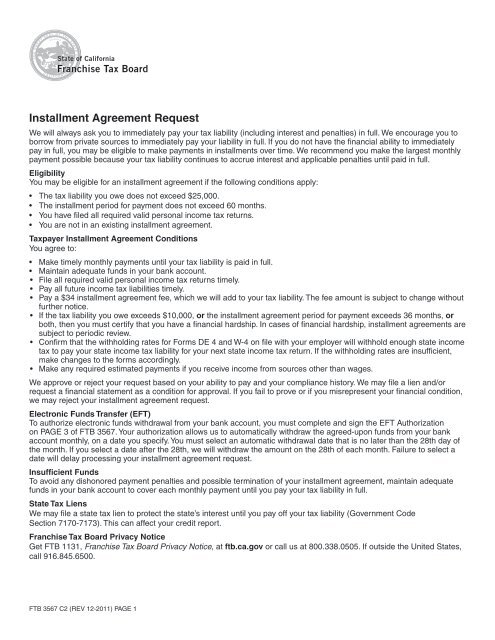

You must owe less than 25000 in state income tax and meet other requirements. Apply online by phone or in-person. We encourage you to borrow from private sources to immediately pay your tax liability in full.

If youre in the unfortunate position that you owe taxes the IRS offers several payment options you can use to pay immediately or arrange to pay in installments. Taxes on real estate are paid in two installments. If you are financially unable to pay the tax liability.

If you cant pay your tax bill in 90 days and want to get on a payment plan you can apply for an installment agreement. Apply by phone mail or in-person. If approved it costs you 50 to set-up an installment agreement added to your balance.

Arrears however is a deceptive term because it. Can you pay Ga state taxes in installments. It may take up to 60 days to process your request.

Like the IRS and many states the California Franchise Tax Board offers taxpayers the ability to pay taxes due over time. You may be eligible for an installment agreement if. If you cant pay your tax bill in 90 days and want to get on a payment plan you can apply for an installment agreement.

If a Full Payment Agreement is not financially attainable you may be eligible for a Long-Term Payment Plan which entails an Installment Agreement. Taxpayers who cannot afford to make a monthly payment can. If the due date falls on a weekend or holiday the deadline for submission and payment without penalty will be extended to the next business day.

Apply for an installment agreement. Can I Pay My Taxes in Installments. Take Advantage of Fresh Start Options.

Youve filed all your income tax returns for the past 5 years. In California you pay half the tax in advance and the other half in arrears of the start of the fiscal year. It takes two payments to pay property taxes.

However its best to act sooner rather than later. If you owe taxes to the State of California but cant pay the full amount on time you may be able to set up a payment plan. Amount due is less than 25000.

And are owed to you in installments unless its a nonpayment by credit card. Ad Trusted A BBB Member. These are levied not only in the income of residents but also in the income earned by non-residents who are working in the state.

Read complete answer here. If you cannot afford to pay your California tax liability you can apply for a monthly payment plan. Cant pay your tax bill and want to complete a payment plan.

Taxes must be paid on the due dates determined by your state law. For example the State of California Franchise Tax Board accepts payment agreements for up to 60 months. To avoid interest and penalties the last day to pay your tax liability in full is April 18 2017.

Plus accrued penalties and interest until the balance is. I have installments set up for my federal taxes but I did not see an option for California state taxes. They are due by November 1st.

Importantly as soon as you know you cant pay back your taxes contact a tax professional. Taxes for the fiscal year are due in one installment on November 1st and the last installment on December 10th. By filling out the form the applicant adds the following information.

Property Taxes can be paid in installments on a monthly basis under the new program. Franchise Tax Board State of California Installment Agreement Request We will always ask you to immediately pay your tax liability including interest and penalties in full. However for a taxpayer to qualify for a remittance agreement all of the following must apply.

How Property Taxes Are Paid In California. A property tax bill for the fiscal year of 2018-19 is sent out on October 1st. Withdrawal of your funds will be based upon the bank account.

The personal income tax rates in California range from 1 to a high of 123 percent. Typically you will have up to 12 months to pay off your balance. An extra 1-percent surcharge is also levied onto.

How Often Do You Pay Property Tax In California.

Lease And Buy Agreement Real Estate Forms Real Estate Real Estate Contract

Understanding California S Sales Tax

Pin On September 2020 Must Read Usa Government Treason

3 Proven Ways To Stop California State Tax Levy On Bank Account

How Much Tax Do You Pay When You Sell Your House In California Property Escape

2008 540 540a Booklet California Franchise Tax Board

San Jose 1886 Old Map Reprint Advertising On Edges Etsy Old Map Map Vintage Map

Understanding California S Sales Tax

Understanding California S Property Taxes

Everything You Need To Know About The 2021 Tax Deadlines Forbes Advisor

Irs Announced Federal Tax Filing And Payment Deadline Extension The Turbotax Blog

California Franchise Tax Board Ftb And Unfiled Taxes Faq Klasing Associates

California Tax Payment Plan Get California Tax Help Today

Understanding California S Property Taxes

California Governor Signs Massive Package And Tax Bill

California Use Tax Information

Installment Agreement Request California Franchise Tax Board

Understanding California S Sales Tax

Sample Commercial Rental Agreement Rental Agreement Templates Room Rental Agreement Commercial